| StockFetcher Forums · General Discussion · XIV | << 1 ... 10 11 12 13 14 ... 22 >>Post Follow-up |

| davesaint86 726 posts msg #141354 - Ignore davesaint86 |

1/25/2018 8:31:18 AM I purchased dfen a few days ago. I'm sitting on a small gain. The DMA8 sell triggered yesterday. Pre-market dfen is up. This one is going sideways and can go either way. |

| nibor100 1,102 posts msg #141362 - Ignore nibor100 |

1/25/2018 1:10:58 PM @davesaint86, A couple of questions about your filters from this thread if you don't mind: 1. Are you as surprised as I am that SF syntax checker doesn't stop your filter from running due to the following snippets? set{E3,"dma(8,-5),8)" draw "dma(8,-5),8)" 2. You've set several "TRIGGER"s to 0, but I don't comprehend their purpose in the filters. Thanks, Ed S. |

| davesaint86 726 posts msg #141363 - Ignore davesaint86 modified |

1/25/2018 1:21:33 PM Ed, To you first question the answer is No since as far as I know displaced moving averages are supported by SF. To answer your second question as far as I know the Trigger is 0 in this filter can be deleted. Sometimes playing around with other filters I add syntax from several filters that is not needed. So in essence the Trigger piece was put in this filter by accident. |

| Mactheriverrat 3,178 posts msg #141367 - Ignore Mactheriverrat |

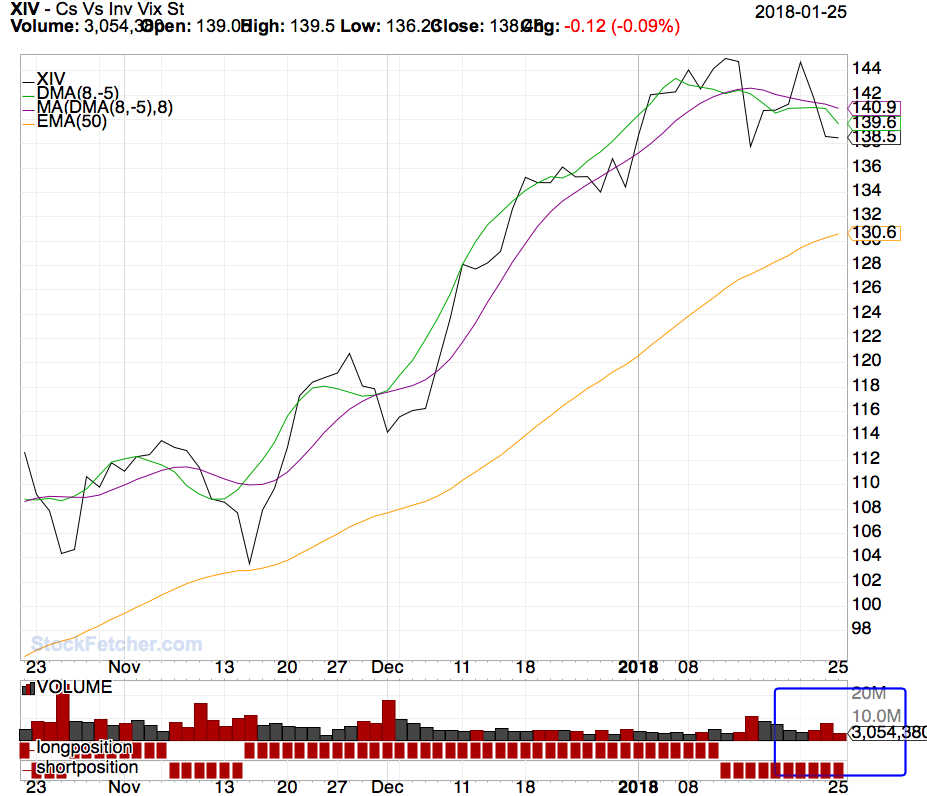

1/25/2018 2:31:07 PM XIV Yesterdays cross has since disappeared  |

| Mactheriverrat 3,178 posts msg #141370 - Ignore Mactheriverrat |

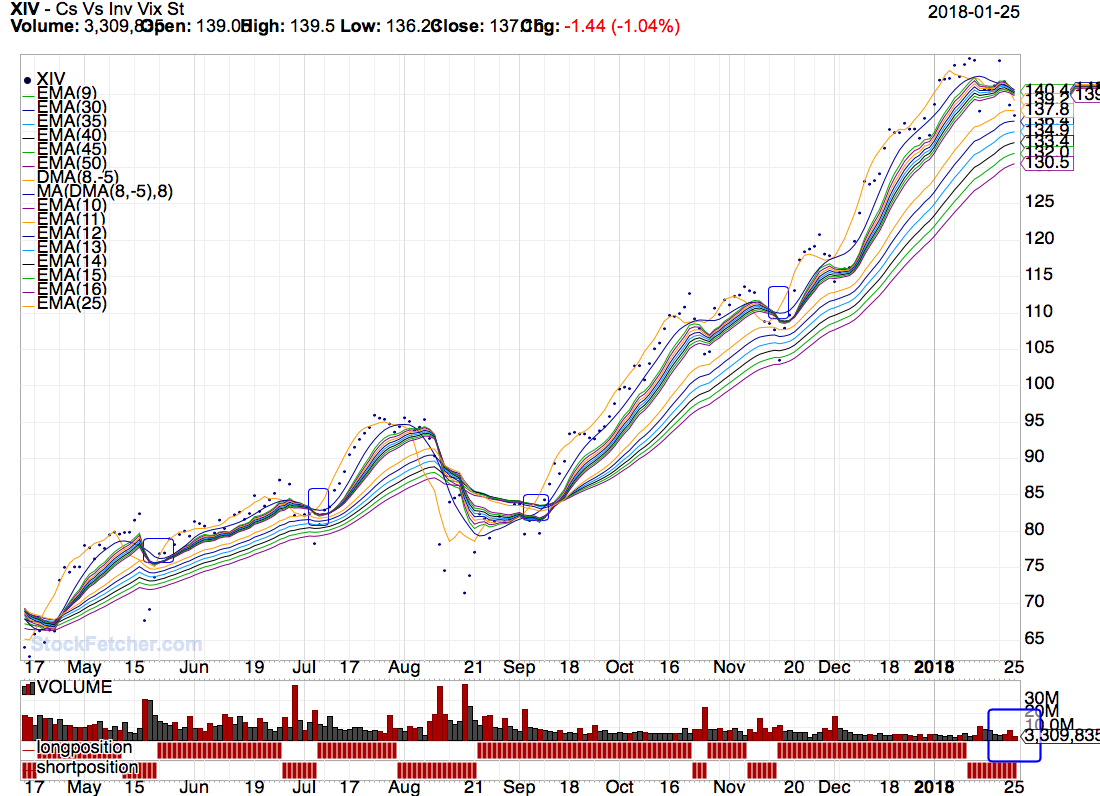

1/25/2018 2:41:05 PM Studying to see how dma(8,-5),8) and cma(DMA(8,-5),8) react when both finally appear above the group of averages using the ema(9) to the ema(16). To see if the change in short term trends are confirmed by dma(8,-5),8) and cma(DMA(8,-5),8) above those averages.  |

| davesaint86 726 posts msg #141377 - Ignore davesaint86 modified |

1/25/2018 3:37:12 PM Mach - From the book that Four posted as a .pdf. One of the benefits why DMA are used is that they keep you from being whipsawed. DISPLACED MOVING AVERAGES Displacing a Moving Average forward in time offers several significant advantages to the trader. 1. It lets you know what the Trend delineation point or price number will be "N" number of periods ahead of time. Knowing where this point is, ahead of time, helps you to plan your market strategy. 2. By using the "proper" number of periods for calculation of the Moving Average and the "proper" displacement amount, DMAs tend to reduce whipsaws and "cup" or contain market action in ways that are very helpful to traders. 3. Certain DMAs are extremely useful in defining patterns, as shown in CHAPTER 6, Directional Indicators. After many years of research spent selecting the proper length and displacement amount, I have arrived at three DMAs. They are: - The 3 period simple Moving Average of the close, displaced forward three periods. - The 7 period simple Moving Average of the close, displaced forward five periods. - The 25 period simple Moving Average of the close, displaced forward five periods. For brevity, they will be shown as follows: 3X3 7X5 25X5 I've answered hundreds of questions on the subject. Since the same questions come up time and again, I think it would be useful to review them. What do you mean by "displaced forward in time" and how does this help reduce whipsaws? Rather than plotting a given Moving Average, calculated today, on today's date, you simply plot the identical value at a different, later date, hence the term "displaced." The displacement is on the time axis, not the price axis. For the visual learners among you, the arrow in the following chart shows that the same Moving Average is simply placed forward in time. All calculations remain identical. For the mathematical types, Appendix A contains a table showing the calculations and where the respective values are placed. You do not use Displaced Moving Averages on intraday charts. Why not? Don't they work? |

| davesaint86 726 posts msg #141385 - Ignore davesaint86 |

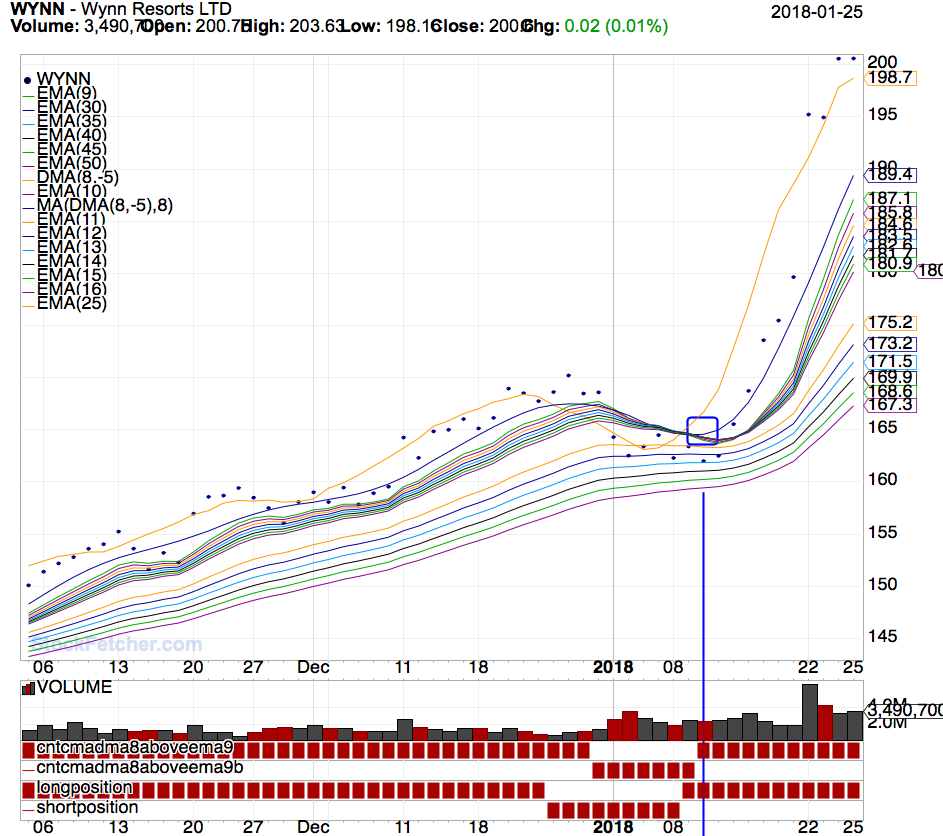

1/25/2018 4:08:57 PM Mach - based on your Guppy/DMA visual it looks like we might be 1-3 days too early. I remember the other chart you posted (Wynn I think) it gave an early signal but then took off. |

| Mactheriverrat 3,178 posts msg #141396 - Ignore Mactheriverrat |

1/25/2018 7:16:22 PM Here's WYNN with cma(DMA(8,-5),8) > eMA(9) one day after a longpositon cross  |

| nibor100 1,102 posts msg #141401 - Ignore nibor100 |

1/26/2018 2:40:14 AM It appears to me that the 2 statements below seem to be improper SF syntax due to the ",8)" at their end: set{E3,"dma(8,-5),8)" draw "dma(8,-5),8)" a. There would appear to be an open parentheses missing and according to SF indicators below is the syntax for the DMA: "Displaced Moving Average / DMA Parameters Period Displacement Usage DMA(25,5) DMA(50,-8)" so I don't understand what the purpose is for the ",8)" nor why it isn't producing a syntax error and stopping filter execution. (normally the smallest syntax error stops a filter cold!) b. Looking at the posted charts SF never actually draws a "dma(8,-5),8)'.but it does draw the DMA(8,-5) which is what I believe everyone actually wants to see. Another SF oddity, Ed S. |

| davesaint86 726 posts msg #141404 - Ignore davesaint86 |

1/26/2018 8:29:45 AM Ed - I don't know. You may be right. Maybe Four can answer this question. |

| StockFetcher Forums · General Discussion · XIV | << 1 ... 10 11 12 13 14 ... 22 >>Post Follow-up |