Mactheriverrat

3,178 posts

msg #152947

- Ignore Mactheriverrat |

7/4/2020 4:21:21 PM

IMHO.

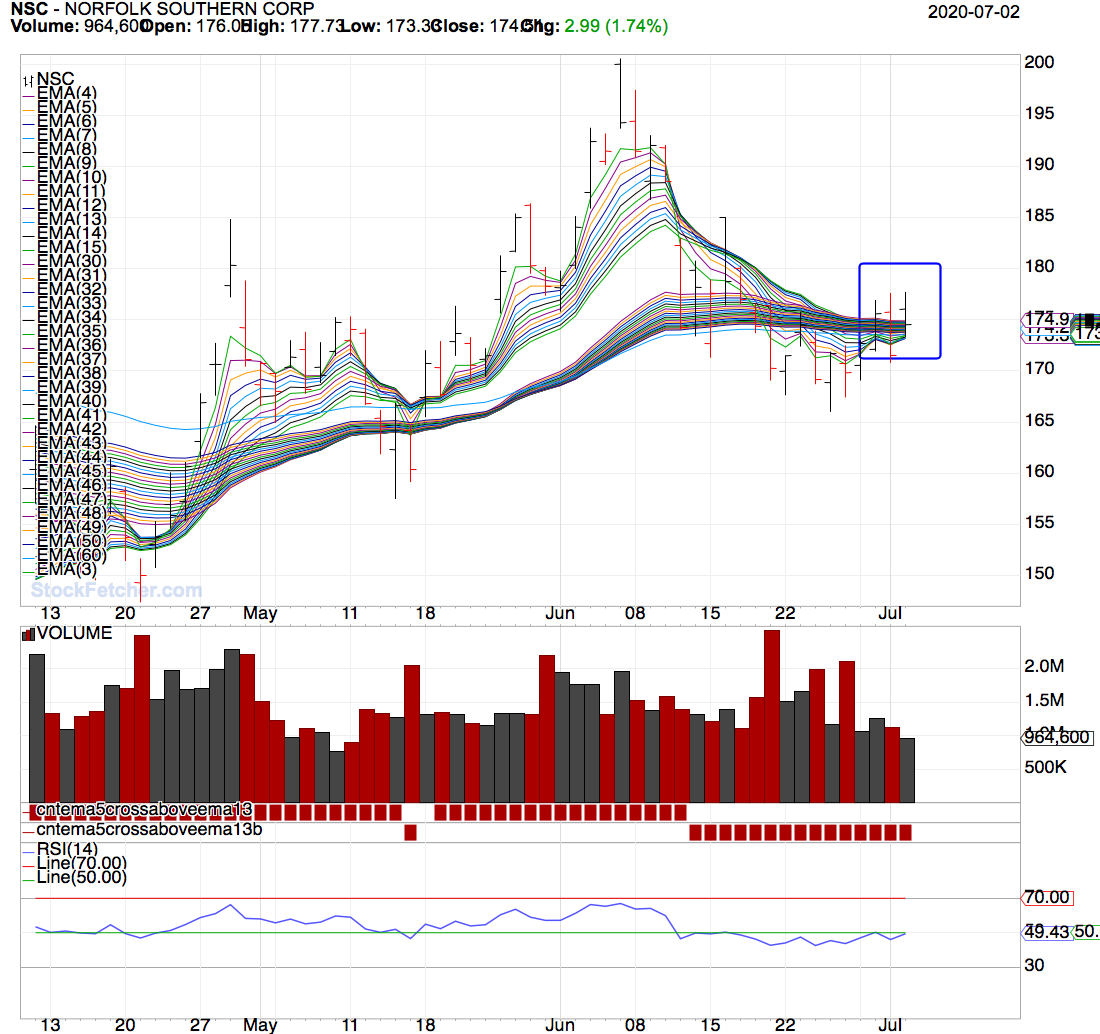

NSC - Long term Bullish, short term still bearish. If EMA 5 can cross above EMA 13 then I would say Buy.

FCN - Long term Bearish , short term ema's starting to intercede with long term - State of possible trend change. Starting to squeeze long term MMA's.

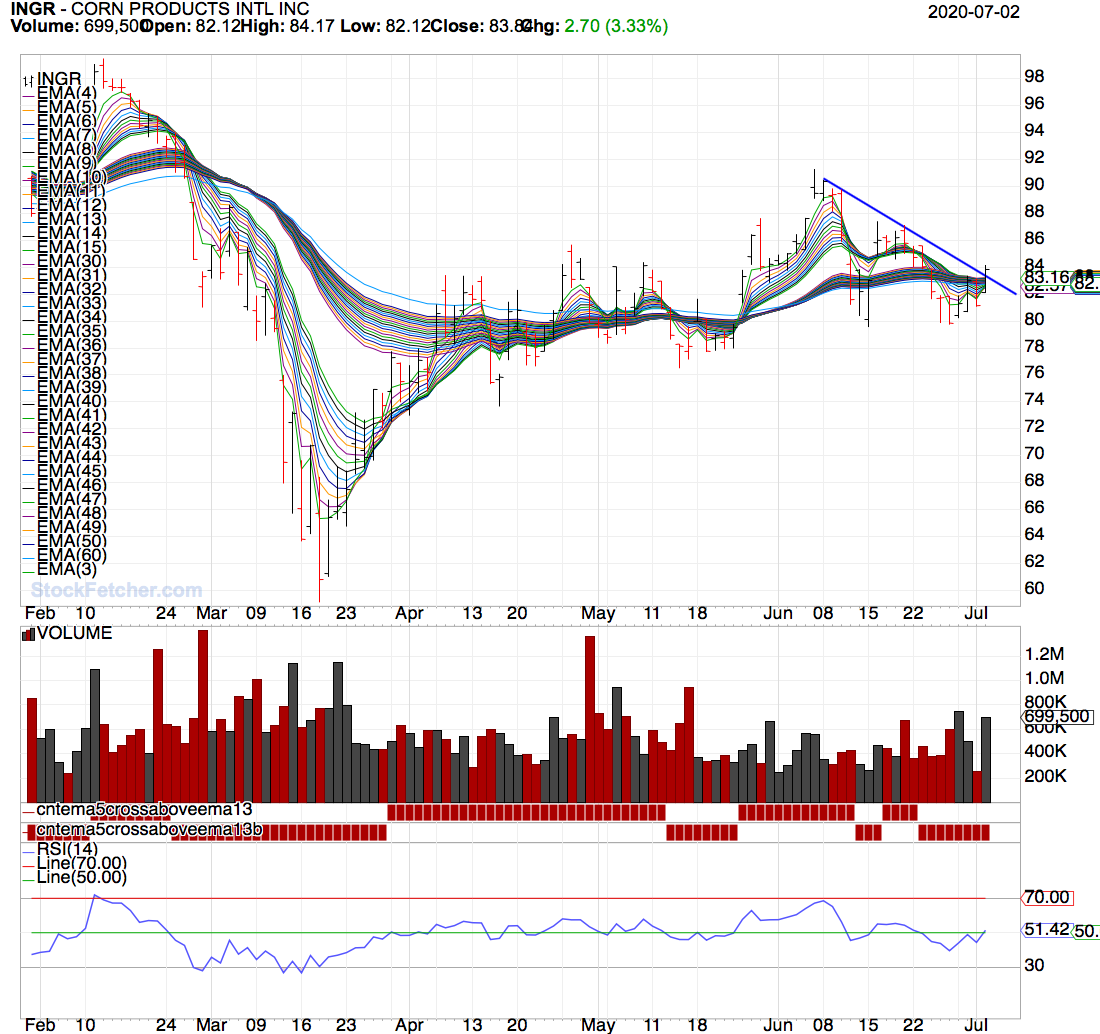

INGR - Long term Bullish , short term pullback without making long term MMA's squeeze or rollover. Like NSC if EMA 5 makes a cross above EMA 13 then its back in. Price broke the down trend line ( a positive).

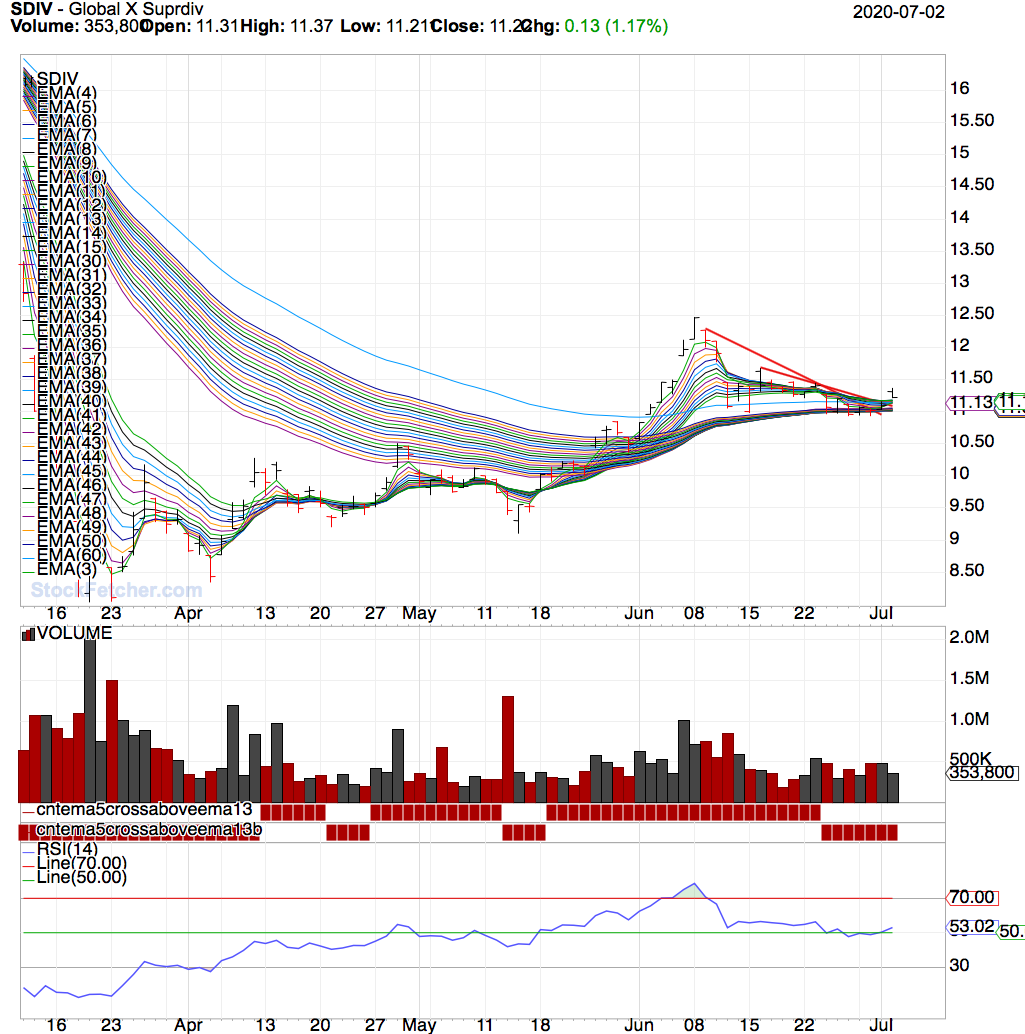

SDIV - Long term very compressed . Seems pull back since around early June never let the long terms rollover. If the short terms can become with say a EMA 5 / 13 cross it will pull the long terms to rollover. Remember that Mr. Guppy said from compression comes expansion. Broke all downtrend lines.

Fetcher[

Submit

|